What is a 401(k) Plan and How to Maximize Its Benefits?

In this unpredictable world, it is often a good idea to plan things ahead of time. People work their entire lives very hard; some have it more challenging than others. They want to provide the best for their family and have a secure future. It is often a sad sight when these same hard-working individuals do not spend their olden days in comfort.

In this unpredictable world, it is often a good idea to plan things ahead of time. People work their entire lives very hard; some have it more challenging than others. They want to provide the best for their family and have a secure future. It is often a sad sight when these same hard-working individuals do not spend their olden days in comfort.

This is where the 401(k) plan comes into action. Employer companies have curated this plan. It works on the scheme that a designated portion of your monthly or annual income is locked away to be looked at once you retire.

Over time, this money accumulates and aggregates to form a significant amount. This prevented people from relying on others for their financial needs in their old days. The 401(k) plan aims to provide a comfortable and reliable retirement life.

Let us take a look at what the 401(k) plan is in detail and how to maximize its benefits.

What Is a 401(k) Plan?

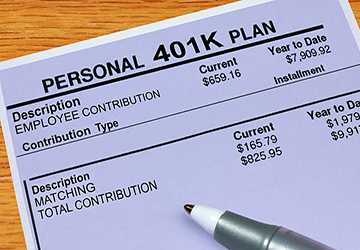

Companies design the 401(K) plan as it suits them. However, the basic structure of this plan is the same for all. By agreeing to a 401(k) plan, an employee permits a fraction of their salary to be contributed to an investment account. The amount you set aside for the account is either matched, or a part of it is also granted by the company.

The 401(k) plan is tax-free and is the finance safety ticket for your retirement.

Types Of 401(k) Plan

There are two variations in this 401(k) plan, “Traditional and Roth”. The primary difference between the two is how these are taxed. The traditional one allows for tax liability to be reduced. They are essentially tax-free. However, the withdrawals are eligible to be taxed.

On the contrary, the Roth version of the 401(k) calls for a portion to be deducted after the income is taxed. However, the withdrawals are entirely tax-free.

How Does The Cashflow Work In 401(k)?

The amount of money that the employee or the employer contributes is entirely subject to inflation. Also, the money you put into this investment account is locked away. This is because taxes and other hassle follow if you want to withdraw cash from the 401(k) account.

Hence, it is strictly recommended that you only allow some of your savings to be invested in this account. Keep some of your savings elsewhere to be quickly brought in hand when required.

Another aspect that one needs to tap into is that if your employer offers both Roth and traditional variants, you can split your amount in two and invest in both sorts of accounts. In this way, you can reap the benefits of both.

How To Maximize Its Benefits?

Customize Your Plan

When you get a job, do not opt for the default set out of the 401(k) plan. Plan your plan according to your income. Try to incorporate more significant amounts in your investment accounts to save more.

The 401(k) Match

If your employer offers the 401(k), use it to the maximum. Essentially, what the match does is that if you can save x% of your pay, you get some additional amount on that. This is an easy way to ensure you get a little push in your investment account.

Sit Tight

The professional aspect that needs to be considered is that your company might only let you leave with an amount from this account if you are entirely vested in the plan. For some organizations, this might translate to a good 6 or 7 years of employment.

Some lenient companies might let you away with some of this account money!

Reduce Your Tax Liability

The bonus aspect here is that the 401(k) plan allows you to save money on your taxes. The amount of money that you keep aside for your retirement is not taxed. This is how tax reductions via credits play a role.

By allowing yourself to invest in the 401(k) plan, you not only secure your future financially but also save some dollars in terms of tax in real time.

Roth Is Beneficial

Young and low-income employees should keep an eye out for the Roth program. If your employer offers it, opt for this one. This allows for after-tax contributions, and the withdrawal is tax-free.

This prevents such employees from snapping away from large tax brackets.

Avoid The Temptation

Whether we like to accept it or not, money that is just sitting feels like it is constantly calling your name. Be firm about not withdrawing money from the 401(k) plan.

Also, in search of better pay of a few hundred dollars more, keep jobs as this prolongs your being wholly vested in the plan with the company.

Conclusion:

And that is all about the 401(k) plan. Now you know how it works and how you can become a part of it. When investing in a retirement account, make sure you do proper calculations between the amount of money you earn and the worth that you are trying to save.

These 401(k) plans are a great way to ensure you secure your future. Also, you can channel your earnings, which is most beneficial for both the short and long terms. So deposit a small amount in these accounts per your situation and live comfortably!