4 Strategies for Using MACD Indicator Efficiently

Jan 01, 2000 By Sana

Advertisement

Are you looking to use the MACD indicator more efficiently in your trading? As an essential momentum indicator, this tool can provide valuable signals for traders, but only if used properly.

This article will explore four practical strategies for utilizing the MACD indicator to its full potential. You're a beginner seeking to master the MACD or an experienced trader hoping to refresh your knowledge.

Are you ready to know about strategies for using these indicators efficiently?

Now, let's go into detail on the key strategies you can use to harness the predictive power of this indicator. Stay tuned, as applying these strategies can significantly enhance your trading accuracy.

1. Complement MACD Signals with Other Indicators

Combine MACD with Other Indicators Relying solely on the MACD can lead to misleading signals. Try combining it with other technical analysis indicators like the RSI or moving averages to look for confirmation.

For instance, the convergence of bullish MACD crossovers with an oversold RSI could strengthen the case for entering an extended position. Using complementary indicators ensures you don't make decisions based on the MACD alone.

Do you tend to use the MACD in isolation? For better accuracy, try utilizing a trading strategy incorporating the RSI or Bollinger Bands next time.

2. Use Both Signal Lines for Entry Points

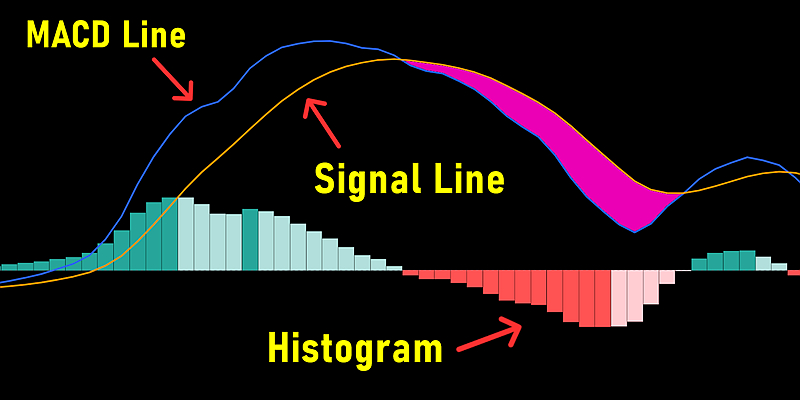

This indicator has two signal lines: MACD and signal lines. Many traders only watch for divergences between both of these indicators to trade.

It's also essential to look for crossover signals between both indicators. Buying when the shorter-term MACD line crosses above the signal line, for example, provides another earlier entry point and a chance for greater profits.

Are you currently just using zero-line crosses to time your trades? Next time, see if you can catch an earlier entry with MACD vs signal line crossover points.

3. Customize the MACD Parameters

Refrain from sticking to the default parameters of 12, 26, and 9 used in the MACD calculation. You can uncover more signals by adjusting these values to fit different trading time frames, instruments, and market conditions better.

For instance, if you trade volatile stocks, try decreasing the parameters to detect quicker reversals. Or increase it when trading slow-moving currency pairs. Optimizing the inputs can lead to trades that align better with prevailing price action.

Do you need help? Do you need help with using the default MACD settings? See if tweaking the parameters to your market improves the timing and accuracy of generated signals next time.

4. Use MACD Histograms for Better Timing

MACD histogram is an additional visual tool for judging momentum direction and strength.

Monitoring the rise and fall of the histogram along with its bars above or below the zero line can help determine optimal trade entry and exit timings. Spikes upwards in the histogram often signal bullish price acceleration, for example.

Next time, pay closer attention to the MACD histogram for potential early warning signs of shifting momentum.

Conclusion

Mastering the usage of the MACD indicator is essential to becoming a skilled trader. While it offers invaluable trade signals, the MACD must be applied prudently by accounting for market context, using confirmations, and customizing parameters.

Just remember no indicator is perfect or sufficient on its own. Strive to combine MACD signals with other confluence factors to determine high-probability trading opportunities.

FAQs

Q. What trading strategies work best with MACD?

Ans. The MACD can be combined effectively with breakout, trend following, and mean reversion strategies for greater accuracy. Also, try using complementary indicators like RSI with MACD for added trade confirmation.

Q. Does MACD work better on specific timeframes?

Ans. The MACD can be used at any time. However, due to its formula, it tends to be most effective for swing trades and investments based on higher time frames such as 4-hour, daily, or weekly charts.

Q. What instruments can MACD be used on reliably?

Ans. The MACD is a versatile indicator that works exceptionally well across forex, stock indices, commodities, and cryptocurrencies. As long as prices exhibit strong trending moves or swings, the MACD signals can help time entries.

Jan 01, 2000

Stock Market

7 Reasons to Incorporate Moving Averages in Your Trading Strategy

This article will share the seven compelling reasons to use moving averages when trading. You'll have a good understanding of how these indicators can improve your trading results.

Jan 01, 2000

Stock Market

7 Winning Strategies for Trading Stocks in a Sideways Market

Are you feeling stuck in the mud lately when trading stocks? You're not alone. Sideways markets, where stock prices meander in a range without clear trends, can frustrate traders.

Jan 01, 2000

Stock Market

Retirement Planning with Stocks

Embarking on the journey towards a financially secure retirement necessitates a multifaceted approach to investments, with a significant focus on the stock market. This detailed exploration emphasizes the pivotal role of retirement stock investing.

Jan 01, 2000

Stock Market

5 Techniques for Enhancing Your Technical Analysis Skills

In this article, we share insights on the methods we've found most helpful in enhancing technical analysis.

Jan 01, 2000

Stock Market

Top 10 Growth Stocks to Watch in Emerging Markets

In the ever-changing stock market landscape, emerging markets present a promising playground for investors seeking growth opportunities.

Jan 01, 2000

Stock Market

Top 10 Insights from Successful Stock Market Investors

Investing in the stock market can be both exhilarating and nerve-wracking, especially if you're navigating the financial waters for the first time. Let's delve into the top wisdom shared by successful stock market investors.

Jan 01, 2000

Stock Market

4 Key Technical Indicators for Effective Market Prediction

This blog post will discuss the four key technical indicators that can significantly improve your analysis and provide compelling market predictions.

Jan 01, 2000

Stock Market

When to Diversify Your Stock Portfolio

Diversification in investment is a strategic approach that involves spreading your investments across various assets, industries, and other categories to manage risk. Its primary aim is to enhance returns by allocating investments in different areas that would respond distinctly to identical events.

Jan 01, 2000

Stock Market

7 Benefits of Using Candlestick Patterns in Stock Analysis

This blog post will discuss the seven core benefits of using candlestick patterns in stock analysis. Are you ready to learn how these patterns can level up your trading?

Jan 01, 2000

Stock Market

How to Create a Winning Stock Watchlist

Creating a winning stock watchlist can be the compass you need to navigate the tumultuous waters of the stock market. This guide breaks down the process into simple, actionable tips that even the greenest investors can follow.

Jan 01, 2000

Stock Market

How to Understand and Invest in Index Funds

In this article, we'll break down the basics and share easy tips to help you understand and master the art of investing in index funds.

Jan 01, 2000

Stock Market

5 Advanced Strategies for Interpreting Stock Market Cycles

This blog post will explore five advanced yet practical strategies to decipher stock market cycles. By implementing these strategies, you'll better understand why the market moves the way it does.

Jan 01, 2000

Stock Market

What Factors Influence Stock Prices the Most

The stock market is a dynamic and multifaceted arena where various factors interplay to determine the movements in stock prices. This article comprehensively analyses the significant factors affecting stock prices, offering fresh insights into the elements that sway the stock market.

Jan 01, 2000

Stock Market

8 Advanced Techniques in Volume Analysis for Stock Trading

In this blog post, we'll explore eight advanced techniques you can utilize in volume analysis to make more informed trading decisions.