7 Winning Strategies for Trading Stocks in a Sideways Market

Jan 01, 2000 By Sana

Advertisement

Are you feeling stuck in the mud lately when trading stocks? You're not alone. Sideways markets, where stock prices meander in a range without clear trends, can frustrate traders.

No matter which ways you try to trade - whether trend-following strategies, breakout techniques, or even buy-and-hold investing - it can seem impossible to book reliable profits.

But what if we told you sideways markets don't need to stop you from succeeding? You can adapt your trading style for various environments with the right toolkit. And not only survive periods of consolidation but actively profit from them.

Are you intrigued by unlocking these market-neutral trading tactics? Then, you'll love the seven powerful, practical strategies we share today for trading stocks in sideways markets.

We'll give you everything from options leveraging to news trading tactics to mean reversion plays. So whether you're a casual stock trader or an active day trader, you can immediately use these approaches to start booking profits in your portfolio.

7 Strategies for Trading Stocks in a Sideways Market

Now, we'll outline the seven rock-solid strategies you can utilize to trade stocks when prices are moving sideways rather than trending.

1. Trade the Obvious Range

When stock prices consolidate into a tight trading range, bounded by well-defined support and resistance - the first high-probability tactic is simply selling into resistance and buying into intraday dips.

This high probability strategy allows you to profit from two directions when prices fluctuate between extreme ranges. Wait for confirmation before entering the counter-trend to prevent overeager tops and bottoms picking.

2. Write Out-of-The-Money Option Credit Spreads

With uncertainty elevated, options traders have an advantage in various markets. A go-to favourite involves writing out-of-the-money credit spreads to profit from time decay.

For example, sell an out-of-the-money call vertical when stock prices approach the upper range boundary. Retain the total credit premium at expiration as prices are below your short strike.

3. Catch Trend Continuation Signals

Ranging markets might lack hard-charging trends, but small directional moves still occur regularly. Traders can profit by catching these mini-trends with swing trade strategies.

The key is waiting for the bounce or breakout confirmation before entering rather than overeager picking of tops and bottoms.

4. Trade Around Market Events

Substantial news events often precede sideways markets. Be sure to trade around earnings reports, FDA decisions, court rulings, and other market-moving events.

The volatility these events spark can lead to profitable breakout and breakdown trades on either side.

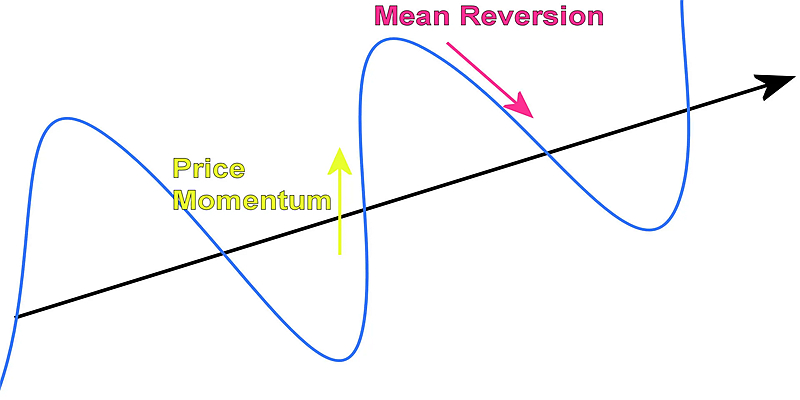

5. Employ Mean Reversion Strategies

Markets can remain irrational longer than you can stay solvent, but eventually, prices revert to the mean.

Use strategies like statistical arbitrage to profit when prices stretch too far from typical levels during low volatility periods. Identify when to buy or short for the coming snapback.

6. Take Advantage of Pullbacks

Trending moves rarely go straight up or down. Use pullbacks or throwbacks to join existing trends spotted during sideways periods.

The key is waiting for the bounce or break confirmation before entering, rather than overeager picking of tops and bottoms.

7. Capitalize on Reversals

Trade candlestick patterns, swing pivots, and other technical signals to spot reversals. Reversals can lead to fast counter-trend moves as other traders get caught wrong-footed.

Again, ensure solid confirmation before entering any reversal setups in choppy markets.

Conclusion

Sideways markets can be frustrating when using trend-following techniques. However, you can reveal several profit opportunities by swinging trade ranges, trading news events, using options, focusing on volume, and identifying reversals.

Mastering range-bound and trending environments will make you a far more adaptable, well-rounded trader.

We hope these seven sideways market trading strategies have given you ideas to implement in your trading. The key is remaining nimble in changing markets while controlling risk in every trade.

So, test these strategies and find the best with your trading plan.

FAQs

Q: What indicators work best for sideways markets?

A: The best indicators for sideways markets include the Average True Range (ATR), Bollinger Bands, Ichimoku Cloud, and the Keltner Channel. These indicators specifically help traders define the market range and spot overextensions.

Q: Should I avoid trading during sideways markets?

A: You don't need to avoid trading sideways markets altogether. Some specific strategies like trading the range, options, and reversals can do quite well. It's about adapting your approach, not simply stopping trading.

Q: What is the difference between a trading range and a sideways market?

A: A trading range is an established price range defined by support and resistance. A sideways market is a broader term referring to any extended period without a sustained uptrend or downtrend. All trading ranges qualify as sideways markets.

On this page

7 Strategies for Trading Stocks in a Sideways Market 1. Trade the Obvious Range 2. Write Out-of-The-Money Option Credit Spreads 3. Catch Trend Continuation Signals 4. Trade Around Market Events 5. Employ Mean Reversion Strategies 6. Take Advantage of Pullbacks 7. Capitalize on Reversals Conclusion FAQs

Jan 01, 2000

Stock Market

8 Advanced Techniques in Volume Analysis for Stock Trading

In this blog post, we'll explore eight advanced techniques you can utilize in volume analysis to make more informed trading decisions.

Jan 01, 2000

Stock Market

How to Understand and Invest in Index Funds

In this article, we'll break down the basics and share easy tips to help you understand and master the art of investing in index funds.

Jan 01, 2000

Stock Market

7 Common Mistakes in Reading Stock Charts and How to Avoid Them?

This blog post will discuss seven common mistakes in reading Stock Charts and how to avoid them. Understanding these common errors can help you become a more brilliant chart reader.

Jan 01, 2000

Stock Market

4 Key Technical Indicators for Effective Market Prediction

This blog post will discuss the four key technical indicators that can significantly improve your analysis and provide compelling market predictions.

Jan 01, 2000

Stock Market

7 Benefits of Using Candlestick Patterns in Stock Analysis

This blog post will discuss the seven core benefits of using candlestick patterns in stock analysis. Are you ready to learn how these patterns can level up your trading?

Jan 01, 2000

Stock Market

How to Understand and Use Stock Market Indicators

The fluctuations in stock prices often resemble a rollercoaster ride. But fear not! Understanding and using stock market indicators can be your trusty guide through the twists and turns of investing.

Jan 01, 2000

Stock Market

Where to Look for Undervalued Stocks

The quest to find undervalued stocks is akin to uncovering hidden treasures in the vast world of investments. This guide is tailored to illuminate the paths for discovering valuable undervalued stock picks that might be overlooked.

Jan 01, 2000

Stock Market

7 Winning Strategies for Trading Stocks in a Sideways Market

Are you feeling stuck in the mud lately when trading stocks? You're not alone. Sideways markets, where stock prices meander in a range without clear trends, can frustrate traders.

Jan 01, 2000

Stock Market

5 Advanced Strategies for Interpreting Stock Market Cycles

This blog post will explore five advanced yet practical strategies to decipher stock market cycles. By implementing these strategies, you'll better understand why the market moves the way it does.

Jan 01, 2000

Stock Market

Top 10 Strategies for Beginner Stock Investors

In this article, we'll break down the top strategies for beginner stock investors in a simple and detailed manner.

Jan 01, 2000

Stock Market

How to Create a Winning Stock Watchlist

Creating a winning stock watchlist can be the compass you need to navigate the tumultuous waters of the stock market. This guide breaks down the process into simple, actionable tips that even the greenest investors can follow.

Jan 01, 2000

Stock Market

4 Strategies for Using MACD Indicator Efficiently

This article will explore four practical strategies for utilizing the MACD indicator to its full potential. You're a beginner seeking to master the MACD or an experienced trader hoping to refresh your knowledge.

Jan 01, 2000

Stock Market

Top 10 Insights from Successful Stock Market Investors

Investing in the stock market can be both exhilarating and nerve-wracking, especially if you're navigating the financial waters for the first time. Let's delve into the top wisdom shared by successful stock market investors.

Jan 01, 2000

Stock Market

When to Diversify Your Stock Portfolio

Diversification in investment is a strategic approach that involves spreading your investments across various assets, industries, and other categories to manage risk. Its primary aim is to enhance returns by allocating investments in different areas that would respond distinctly to identical events.