8 Advanced Techniques in Volume Analysis for Stock Trading

Jan 01, 2000 By Sana

Advertisement

Are you looking to enhance your stock trading strategy? Accurately analyzing trading volume can give you a strategic edge as an investor. Volume analysis provides critical insights into supply and demand dynamics and can help determine when to enter or exit trades.

In this blog post, we'll explore eight advanced techniques you can utilize in volume analysis to make more informed trading decisions.

Whether you're a beginner seeking to learn technical analysis or a seasoned trader looking to sharpen your skills, read on to discover how to unlock the power of volume.

8 Advanced Techniques in Volume Analysis

Understanding volume analysis is a vital skill for stock traders. The amount of volume during a price move indicates the strength of that move. Higher volume on up moves often signals increased buying pressure, while high volume on down moves generally shows intense selling pressure.

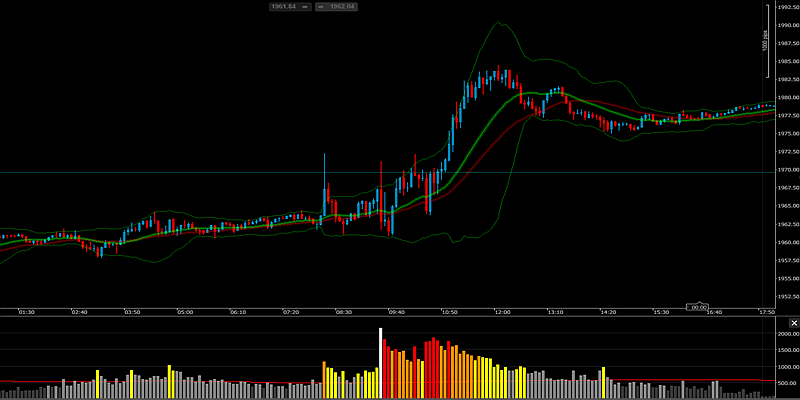

1. Volume Weighted Average Price

Volume Weighted Average Price (VWAP) shows the typical price of a stock traded over time, weighted by volume. Comparing the current price to VWAP determines if a stock is overbought/oversold relative to its volume-weighted valuation.

Trading near VWAP suggests a balanced market. Diverging far above or below VWAP signals imbalance and potential reversion to volume-weighted levels.

2. Volume Surges

Monitoring intraday or daily volume levels for sharp surges signals major players aggressively accumulating or distributing shares. Volume escalating dramatically higher than recent norms reflects urgent buying or selling pressure.

Massive volume surges validate accurate supply/demand imbalances that propel powerful directional moves rather than short-lived volatility spikes.

3. Volume by Price

Studying volume transacted around certain price levels identifies areas of support and resistance. Zones with consistently heavy volume over time highlight where reactive supply and demand tend to emerge.

If the price revisits these high-volume areas, especially after a period of pullback/consolidation, it signals potential turning points.

4. Volume Spreads

Volume spread analysis examines the difference in volume activity between up bars vs. down bars to spot trend reversals. Wider spreads signal potential exhaustion points.

Narrow spreads reflect equilibrium where bulls and bears share similar convictions. Monitoring compressing and expanding spreads aids the timing of corrections.

5. Volume Oscillators

Volume oscillators like Chaikin Money Flow or Klinger Oscillator produce overbought and oversold trade signals by comparing volume momentum against price action.

The divergence between oscillator direction and price often leads to extreme reversals. As leading indicators of building supply/demand, they improve entry/exit timing.

6. Volume Moving Averages

Volume moving averages smooth raw volume into objective trends, highlighting periods of consistently high or low participation.

Comparing price action to rising/falling volume averages provides context for breakouts and corrections. Volume confirming price suggests sustainability, while divergence signals caution about overextension.

7. Tick Volume

Analyzing tick volume measures the frequency of trades at different price levels to reveal developing areas of support and resistance.

Rising tick volume into weakness signals absorbing orders and renewed buying interest. Falling tick volume into strength reflects limited demand and potential exhaustion ahead.

8. Volume Profile

Volume profile visually depicts where trades are concentrated on a chart over time. Value areas emerge around prices attracting the most transactions.

If the price returns to areas of high volume acceptance, it often signals supportive rebounds or topping formations as the herd re-enters.

Conclusion

There you have it8 powerful techniques to incorporate volume analysis into your stock trading plan. From confirming breakouts to identifying exhaustion moves, the volume provides the context to understand price action better.

Volume reflects the actions of market participants rather than just price fluctuations. Mastering these advanced volume analysis methods will give you an edge in determining high-probability trades.

Whether you use VWAP comparisons, volume spreads, volume profile analysis or a combination of indicators, make the volume a central component of your trading strategy. Add these weapons to your arsenal so you can trade with confidence.

FAQs

Q: What are some benefits of using volume analysis for stock trading?

Ans: Some key benefits include confirming price trends, spotting reversals early, identifying support and resistance zones, gauging market sentiment, and improving timing for entries and exits. Volume analysis provides crucial insights unattainable with price data alone.

Q: What chart time frame is best for volume analysis?

Ans: The most suitable time frame depends on your trading style. For intraday trading, 5, 10 and 15-minute charts are standard. Swing traders often analyze 60-minute and daily charts. But you can apply volume techniques on any time frame from 1 minute to weekly.

Jan 01, 2000

Stock Market

Top 10 Insights from Successful Stock Market Investors

Investing in the stock market can be both exhilarating and nerve-wracking, especially if you're navigating the financial waters for the first time. Let's delve into the top wisdom shared by successful stock market investors.

Jan 01, 2000

Stock Market

Top 10 Strategies for Beginner Stock Investors

In this article, we'll break down the top strategies for beginner stock investors in a simple and detailed manner.

Jan 01, 2000

Stock Market

7 Winning Strategies for Trading Stocks in a Sideways Market

Are you feeling stuck in the mud lately when trading stocks? You're not alone. Sideways markets, where stock prices meander in a range without clear trends, can frustrate traders.

Jan 01, 2000

Stock Market

What Factors Influence Stock Prices the Most

The stock market is a dynamic and multifaceted arena where various factors interplay to determine the movements in stock prices. This article comprehensively analyses the significant factors affecting stock prices, offering fresh insights into the elements that sway the stock market.

Jan 01, 2000

Stock Market

Top 5 Mistakes New Stock Investors Make

This detailed guide aims to shed light on the top five blunders new stock market participants commonly make. By recognizing and steering clear of these frequent missteps, one can approach stock investment with greater confidence and insight.

Jan 01, 2000

Stock Market

Top 10 Growth Stocks to Watch in Emerging Markets

In the ever-changing stock market landscape, emerging markets present a promising playground for investors seeking growth opportunities.

Jan 01, 2000

Stock Market

How to Invest in Blue-Chip Stocks Wisely

"Blue-chip funds" are equities of well-known companies with an established reputation in the shares market and a history of steady success. Here are some pointers to help novices who want to dabble in investing make an intelligent navigation of the blue-chip shares market.

Jan 01, 2000

Stock Market

5 Techniques for Enhancing Your Technical Analysis Skills

In this article, we share insights on the methods we've found most helpful in enhancing technical analysis.

Jan 01, 2000

Stock Market

8 Advanced Techniques in Volume Analysis for Stock Trading

In this blog post, we'll explore eight advanced techniques you can utilize in volume analysis to make more informed trading decisions.

Jan 01, 2000

Stock Market

How to Avoid Emotional Investing

Mastering the art of avoiding emotional trading starts with recognizing the emotional responses that typically disrupt logical investment decisions. Key emotions such as anxiety, euphoria, or overconfidence can skew an investor's perspective, leading to choices that stray from their investment objectives or the market's reality.

Jan 01, 2000

Stock Market

Retirement Planning with Stocks

Embarking on the journey towards a financially secure retirement necessitates a multifaceted approach to investments, with a significant focus on the stock market. This detailed exploration emphasizes the pivotal role of retirement stock investing.

Jan 01, 2000

Stock Market

Where to Look for Undervalued Stocks

The quest to find undervalued stocks is akin to uncovering hidden treasures in the vast world of investments. This guide is tailored to illuminate the paths for discovering valuable undervalued stock picks that might be overlooked.

Jan 01, 2000

Stock Market

Where to Get Real-Time Stock Alerts

In the dynamic realm of stock trading, staying informed with immediate updates is critical for investors. This guide delves into the top methods to access real-time stock alerts, ensuring you're always on top of market fluctuations.

Jan 01, 2000

Stock Market

5 Advanced Strategies for Interpreting Stock Market Cycles

This blog post will explore five advanced yet practical strategies to decipher stock market cycles. By implementing these strategies, you'll better understand why the market moves the way it does.