How to Understand and Use Stock Market Indicators

Jan 01, 2000 By Sannan

Advertisement

The fluctuations in stock prices often resemble a rollercoaster ride. But fear not! Understanding and using stock market indicators can be your trusty guide through the twists and turns of investing. Let's break it down into top tips that will have you navigating the market like a pro.

Get to Know the Basics

Before diving into the world of stock market indicators, let's start with the basics. Indicators are your financial compass they help you gauge the market's direction. A moving average is among the primary indicators. It's like the calm in the storm, smoothing out the daily market noise. Here's the deal: A moving average takes the average price of a stock over a specific period, say 50 days. If the current price is above the moving average, things look bullish. Below, and it might be time to proceed with caution.

Embrace the RSI (Relative Strength Index)

Don't let the fancy name scare you away. When identifying oversold or overbought situations, the RSI becomes your partner. It's like the friend who tells you when to step back from the buffet moderation is vital. The RSI ranges from 0 to 100, and here's the trick: if it's above 70, the stock may be overbought (time to sell); if it's below 30, the stock might be oversold (opportunity to buy). It's like having a warning system for when things might get too extreme.

Dive into MACD (Moving Average Convergence Divergence)

Okay, buckle up! We're getting into a bit more advanced territory but fear not we'll keep it simple. MACD is a stock indicator that may uncover hidden patterns, much like Sherlock Holmes. Here's the lowdown: MACD compares two moving stock price averages. A bullish warning (buy time) happens if the MACD trend line moves beyond the indicator line. A bearish indication, on the other hand, indicates that a decline may be imminent when it falls below.

Pay Attention to Volume

Finally, volume is like the heartbeat of the stock market. Picture this: a stock makes a big move, but if the volume is low, it's like a party with no guests not exciting. Volume indicates the number of shares traded, and a surge in volume during a price move suggests firm conviction. It's like having a chorus of voices saying, "This is the real deal!" Pay attention when volume confirms a price move it adds weight to the market's sentiment.

Putting It All Together

Now that we've covered the basics let's tie it together. Imagine baking a cake each indicator is like a crucial ingredient. You wouldn't skip the flour or sugar, right? Similarly, combining these indicators can give you a well-rounded view of the market. For instance, if the moving average shows an uptrend, the RSI is below 70, and the MACD gives a bullish signal it's like the universe aligning for a potential buying opportunity. Conversely, if the moving average is trending down, the RSI is above 70, and the MACD signals are bearish, it might be time to consider selling. Remember, though, no indicator is foolproof. It's like weather forecasts sometimes they're spot on, and other times, not so much. Use these indicators as tools, not crystal balls.

Bonus Tip: Stay Informed and Be Patient

Before we wrap up, here's a bonus tip stay informed and be patient. The market is a living, breathing entity influenced by news, events, and sometimes a collective mood swing. Monitor financial news, economic reports, and significant developments that could impact your investments. Patience is key. Just as Rome was not built overnight, neither will your investing portfolio. Don't let short-term fluctuations rattle your nerves. Please stick to your strategy and let time do its magic.

Bollinger Bands

Think of Bollinger Bands as the guardrails of the stock market highway. Two standard deviation lines and a trending average make up these bands. Price hugging the band at the top might indicate that stocks are overbought, like a car sliding dangerously near the brink. Conversely, it could be oversold when it touches the lower band. Here's the trick: A reversal might be on the horizon if the price pierces the upper band. Conversely, if it breaches the lower band, a turnaround to the upside could be in the cards. You may observe volatility and gain insights about probable trend reversals using Bollinger Bands.

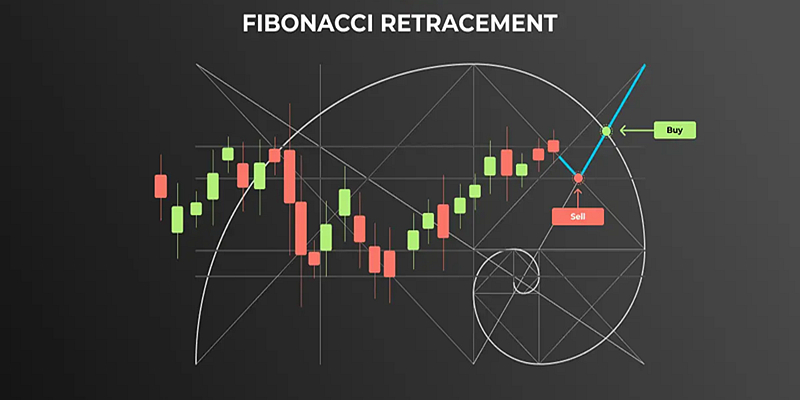

Fibonacci Retracement

Now, let's add a touch of Fibonacci magic to the mix. A treasure map-like tool for locating possible levels of resistance and support is the Fibonacci retracement. The theory is that following a significant price shift, the stock could retrace a portion of the change before moving forward again. Picture this: After a stock surges, you can use Fibonacci retracement levels (38.2%, 50%, and 61.8%) to spot where it might pull back before resuming its upward journey. It's like having a roadmap to anticipate possible entry or exit points.

Stochastic Oscillator

Are you feeling like a detective yet? Good, because the Stochastic Oscillator is your magnifying glass for spotting potential trend reversals. This indicator looks at a stock's closing price over a given periodusually 14 daysand compares it with its average price range. When the Stochastic Oscillator crosses above 80, it's like a signal saying, "Hold on, things might be getting overheated" a potential sell indicator. On the contrary, when it drops below 20, it's like a whisper, "Hey, the stock might be oversold" an opportunity to consider buying.

Conclusion

With these four additional indicators Bollinger Bands, Fibonacci Retracement, Stochastic Oscillator, and Average True Range you've expanded your arsenal for decoding the stock market's language. Remember, each indicator contributes a unique perspective, and combining them can enhance your decision-making. As you venture into the fascinating world of stock market indicators, keep practicing and refining your understanding. The more you engage with these tools, the more confident you'll become in navigating the twists and turns of the financial landscape.

On this page

Jan 01, 2000

Stock Market

7 Common Mistakes in Reading Stock Charts and How to Avoid Them?

This blog post will discuss seven common mistakes in reading Stock Charts and how to avoid them. Understanding these common errors can help you become a more brilliant chart reader.

Jan 01, 2000

Stock Market

How to Understand and Use Stock Market Indicators

The fluctuations in stock prices often resemble a rollercoaster ride. But fear not! Understanding and using stock market indicators can be your trusty guide through the twists and turns of investing.

Jan 01, 2000

Stock Market

Top 5 Mistakes New Stock Investors Make

This detailed guide aims to shed light on the top five blunders new stock market participants commonly make. By recognizing and steering clear of these frequent missteps, one can approach stock investment with greater confidence and insight.

Jan 01, 2000

Stock Market

When to Diversify Your Stock Portfolio

Diversification in investment is a strategic approach that involves spreading your investments across various assets, industries, and other categories to manage risk. Its primary aim is to enhance returns by allocating investments in different areas that would respond distinctly to identical events.

Jan 01, 2000

Stock Market

6 Effective Methods for Trend Analysis in Stock Markets

This post uncovers six straightforward methods to identify trends, forecast changes, and boost performance. Applying these tools transforms investing from a game of chance into a strategic endeavour.

Jan 01, 2000

Stock Market

8 Advanced Techniques in Volume Analysis for Stock Trading

In this blog post, we'll explore eight advanced techniques you can utilize in volume analysis to make more informed trading decisions.

Jan 01, 2000

Stock Market

5 Advanced Strategies for Interpreting Stock Market Cycles

This blog post will explore five advanced yet practical strategies to decipher stock market cycles. By implementing these strategies, you'll better understand why the market moves the way it does.

Jan 01, 2000

Stock Market

4 Key Technical Indicators for Effective Market Prediction

This blog post will discuss the four key technical indicators that can significantly improve your analysis and provide compelling market predictions.

Jan 01, 2000

Stock Market

4 Strategies for Using MACD Indicator Efficiently

This article will explore four practical strategies for utilizing the MACD indicator to its full potential. You're a beginner seeking to master the MACD or an experienced trader hoping to refresh your knowledge.

Jan 01, 2000

Stock Market

How to Invest in Blue-Chip Stocks Wisely

"Blue-chip funds" are equities of well-known companies with an established reputation in the shares market and a history of steady success. Here are some pointers to help novices who want to dabble in investing make an intelligent navigation of the blue-chip shares market.

Jan 01, 2000

Stock Market

Where to Look for Undervalued Stocks

The quest to find undervalued stocks is akin to uncovering hidden treasures in the vast world of investments. This guide is tailored to illuminate the paths for discovering valuable undervalued stock picks that might be overlooked.

Jan 01, 2000

Stock Market

Top 10 Insights from Successful Stock Market Investors

Investing in the stock market can be both exhilarating and nerve-wracking, especially if you're navigating the financial waters for the first time. Let's delve into the top wisdom shared by successful stock market investors.

Jan 01, 2000

Stock Market

How to Avoid Emotional Investing

Mastering the art of avoiding emotional trading starts with recognizing the emotional responses that typically disrupt logical investment decisions. Key emotions such as anxiety, euphoria, or overconfidence can skew an investor's perspective, leading to choices that stray from their investment objectives or the market's reality.

Jan 01, 2000

Stock Market

What Factors Influence Stock Prices the Most

The stock market is a dynamic and multifaceted arena where various factors interplay to determine the movements in stock prices. This article comprehensively analyses the significant factors affecting stock prices, offering fresh insights into the elements that sway the stock market.